Dutch tax system

Help with all your Dutch taxes, think of the M-form, 30% ruling, income tax, and VAT return

In the Netherlands, we use a box system to calculate how much tax you have to pay. There are three boxes.

Box 1 is about all your income generated by work, so for example income from employment, pension, or former work. In box 1 you can declare deductions as well (e.g., health costs, alimony, and mortgage interest).

Box 2 is applicable when you have more than 5% of the shares of a company. If you receive a dividend or payment from this company, you had to pay 26.9% (2023) Dutch income tax in Box 2.

Since January 1, 2024, you pay 24.50% tax on income from a substantial interest up to € 67,000. You pay 33% tax on income from a substantial interest from € 67,000.

In box 3, you pay tax on income from savings and investments. However, everyone is allowed to have a tax-free amount of capital. In 2024, this tax-free amount is €57,000 for an individual and €114,000 for a couple.

The Dutch tax system changes every year, so we understand that it is difficult to know all the exact rules. Nevertheless, it is wise to know the basic principles of the tax system, since this can save you money and a lot of stress. On this page, we explain the basic principles of the Dutch tax system for you.

Leave your details in our online contact form or call us at +31 20 – 2170120 and we will get in touch to see if we can help you with filing the tax return.

In the Netherlands we have different kinds of taxes for individuals.

When you earn money while living in the Netherlands, you are required to pay tax on your world income. This can lead to double taxation when you have assets or income abroad, however, tax treaties often provide taxation relief. When you live outside the Netherlands but you earn Dutch income, you are required to pay tax on your Dutch income. When you’re employed by a company, the income tax is already withheld from your salary.

The income tax has to be declared via the annual tax return. This can be done online or together with a tax advisor. The annual tax return should be filed before May 1.

Payroll taxes are withheld from your salary. It contains the tax mentioned before, as well as national contributions, e.g., for your pension or unemployment allowances.

This means that there is a big difference between the gross and net salary (after payroll tax deduction), it’s important to keep that in mind when you start a new job in the Netherlands.

In the Netherlands, entrepreneurs (self-employed) deal with two tax returns.

Also when you are self-employed, you have to pay income tax. When you are self-employed, you should withhold the income tax yourself. You can calculate and pay the amount via the annual tax return. In addition to regular deductible items, you are eligible for special deductions for entrepreneurs if you are seen as an entrepreneur for income tax purposes.

If you are self-employed (entrepreneur), you also have to file the VAT return (most likely every quarter). Here, you state the VAT you received from your customers and paid to your suppliers. We are happy to help you file the VAT return. Leave your details in our online contact form or call us at +31 20 – 2170120 and we will get in touch to see how we can help you.

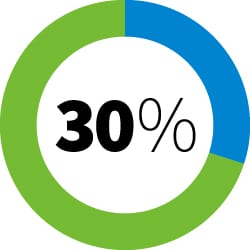

The 30% ruling is an interesting feature for expat employees in the Netherlands. This ruling is especially for highly skilled people with specific expertise that is scarce in the Netherlands. However, there are strict requirements you should meet. Here you can see what the conditions are. The most important element of this ruling is a reduction of your taxable income. When this ruling applies in your situation, only 70% of your income is used when determining the amount of income tax you are required to pay. This means that 30% of your income is tax-free.

Speak directly with one of our tax advisors

Could you use some help with your Dutch taxes, like your income tax return, provisional tax return, or application of the 30% ruling?

Please, contact us using the details mentioned below.

Fill in our contact form, and we will get in touch

Send your message to +31 20 – 2170120

Call us on +31 20 – 2170120