Frequently Asked | 30% ruling

We have several international clients who came to the Netherlands, and we use this section to answer the most frequently asked questions. On this page, we will answer the frequently asked questions related to 30% ruling.

What is the 30% ruling?

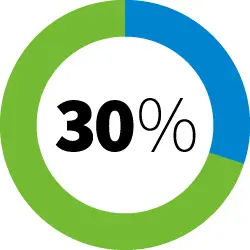

The 30% ruling is a tax advantage for highly skilled migrants who moved to the Netherlands for a specific employment role. When you’re eligible for this, you don’t have to pay tax over 30% of your gross salary in the Netherlands.

Do I qualify for the 30% ruling?

To benefit from the 30% ruling, you must meet several requirements.

The first one is the income requirement. The income requirement is used as a measure of knowledge that is not available on the Dutch labour market. In 2024, the minimum taxable salary norm is set at €46.107. But please note, employees younger than 30 years with a Masters of Sciences degree (MSc) degree is a reduced gross salary required, namely €35.048.

Other requirements are that you:

- Are an employee of a company in the Netherlands

- Need specific professional expertise that is scarce in the Netherlands

- And your employer agrees in writing that the 30% ruling applies to your situation.

- Must be recruited from abroad.

What are the benefits?

Besides the tax-free salary part, there are more benefits to the 30% ruling.

Partitial non-residence status

A Dutch tax resident with the 30% ruling can choose to be treated by the Belastingdienst as a partial non-resident taxpayer of the Netherlands. This means that you will be considered as a non-resident taxpayer in Box 2 and 3. So, in that case, you don’t have to pay income tax on assets in Box 2 and 3 (besides real estate located in the Netherlands and substantial shareholding in a Dutch BV) when you file the annual income tax return.

Exchange of foreign driver’s license

Another benefit of the 30% ruling is the possibility to exchange your foreign driver’s license. In most cases, you have to redo your driver’s license test in order to obtain a Dutch driver’s license. If you have the 30% ruling. It is possible to exchange your foreign driver’s licence for a Dutch license without redoing the test. And even all of your family members at the same address as the holder of the 30% ruling don’t have to redo the test.

How do I apply for the 30% ruling?

To apply for the 30% ruling you and your employer have to ask the Belastingdienst permission to make use of the 30% ruling. You and your employer can ask for permission by filling out the following form: Application income tax and national insurance.

Give us a call and we are happy to help!

Do you still have any questions after reading the frequently asked questions of our customers? Don’t hesitate to ask them. Or do you want help with filing the annual tax return? Fill in our contact form or give us a call on +31 (0)20 – 2170120.

TaxSavers

Amsterdamseweg 71A

1182GP Amstelveen

E. info@taxsavers.nl

T. +31 20 – 2170120

Office hours

Monday to Thursday 09:00-18:00

Friday 08:30-17:00

BTW-registration NL859458301B01 (VAT)

Kvk-registration: 73318752

(Chamber of Commerce)